contra costa county sales tax calculator

The voter-approved bonds that make up the tax rate cannot be changed. Steps 1 to 3 will allow you to calculate Sales Tax on the net or gross sales cost of goods andor services.

Edd Payroll Taxes Service Details Www Ca Gov

This tool can calculate the transferexcise taxes for a sale or reverse the calculation to estimate the sales price.

. But remember that your property tax dollars pay. The minimum combined 2022 sales tax rate for Contra Costa County California is. If youre a resident of Alameda County California and you own property your annual property tax bill is probably not your favorite piece of mail.

This is the total of state and county sales tax rates. We will consider Contra Costa County transfer tax in this article. NETR Online Contra Costa Contra Costa Public Records Search Contra Costa Records Contra Costa Property Tax California Property Search California Assessor.

Denotes required field. Weve collated all the information you need regarding Contra Costa taxes. The latest sales tax rate for Port Costa CA.

The Contra Costa County California sales tax is 825 consisting of 600 California state sales tax and 225 Contra Costa County local sales taxesThe local sales tax consists of a 025. Calculator Mode Calculate. From the Marvel Universe.

Welcome to the TransferExcise Tax Calculator. Ad Manage sales tax calculations and exemption compliance without leaving your ERP. If you think the value of the property is incorrect please contact the Assessors Office at 925-313-7600.

Contra Costa County in California has a tax rate of 825 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Contra Costa County totaling 075. Chicago Title Transfer Tax and City Tax Calculator. Welcome to the Tax Portal.

In California both the county and the city impose a transfer tax on the sale of real estate. The total property tax rate for the area including any local bonds To calculate a rough average for Contra Costa County we can use the countywide median home price and a typical tax rate. This county tax rate applies to areas that are within the boundaries of any incorporated cities.

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 923 in Contra Costa County. Peruse rates information view relief programs make a payment or contact one of our. Save thousands on a.

The base sales tax in California is 725You can also use Sales Tax calculator at the front page where you can fill in percentages by. This tool can calculate the transferexcise taxes for a sale or reverse the calculation to estimate the sales price. 2020 rates included for use while preparing your income tax deduction.

Contra Costa County Sales Tax Calculator For 2021. Puerto Rico has a 105. The Contra Costa County Sales Tax is collected by the merchant on all.

Sales Tax Table For Contra Costa County California. Avalara provides supported pre-built integration. The current total local sales tax rate in Contra Costa County CA is 8750.

1788 rows CDTFA public counters are now open for scheduling of in-person video or phone appointments. This rate includes any state county city and local sales taxes. The December 2020 total local sales tax rate was 8250.

The minimum combined 2022 sales tax rate for Contra Costa County California is. US Sales Tax calculator California Contra Costa. The Contra Costa County California Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Contra Costa County California in the USA using average.

What is the sales tax rate in Contra Costa County.

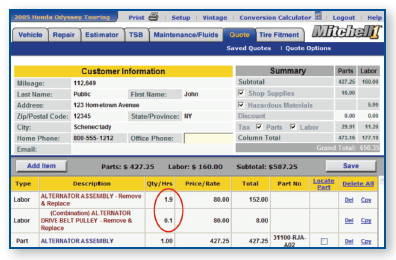

Auto Repair Labor Rates Explained Aaa Automotive

Gorgeous And Exclusive 572 Dalewood Drive Orinda Ca 94563 Orinda Ca Real Estate Orinda Ca Home For S Real Estate Real Estate Agent Contra Costa County

Riverside County Ca Property Tax Search And Records Propertyshark

California Sales Tax Rates By City County 2022

California Vehicle Sales Tax Fees Calculator

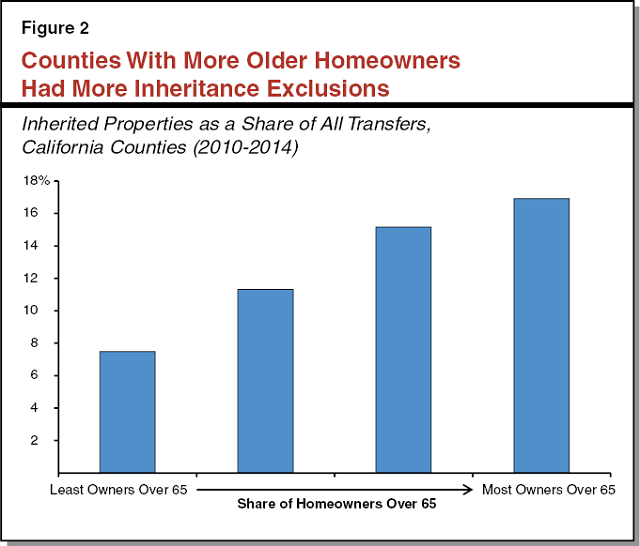

The Property Tax Inheritance Exclusion

The Property Tax Inheritance Exclusion

Home Closing Process For Sellers In California What Are The Costs New Venture Escrow

Riverside County Ca Property Tax Search And Records Propertyshark

Riverside County Ca Property Tax Search And Records Propertyshark

California Vehicle Sales Tax Fees Calculator

California Vehicle Sales Tax Fees Calculator

California Vehicle Sales Tax Fees Calculator

California Vehicle Sales Tax Fees Calculator